-

Tim Page

Tim PagePreparing for the new UK Corporate Governance Code

Read moreFollowing the FRC’s publication of the UK Corporate Governance Code 2024 and associated guidance, the clock is now ticking for boards to fully understand the key changes and take action to review and update their governance arrangements where necessary. Our latest indigoINSIGHT explores the next steps for boards to consider in preparation for the new requirements.

-

Tim Page

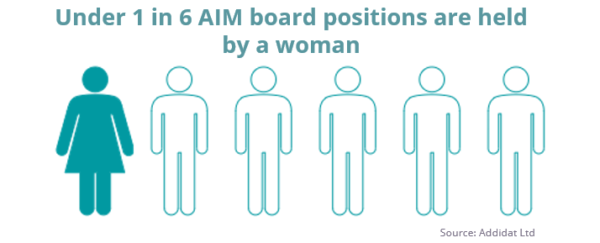

Tim PageGender diversity in AIM company boards

Read moreIn celebration of International Women’s Day 2024, Addidat and Indigo: Independent Governance are delighted to collaborate for a second year to provide insights into gender diversity on the boards of AIM quoted companies. Despite some progress, the lethargic pace of change remains disappointing, with 37% of AIM firms still lacking female representation. Diversity remains a crucial factor for optimising board effectiveness and commercial success and boards are therefore urged to take stock of their approach to equality and inclusion.

-

Tim Page

Tim PageGuidance to the UK Corporate Governance Code 2024

Read moreIn the second Indigo INSIGHT in our series addressing changes to the UK Corporate Governance Code, we look at the guidance released by the FRC to support boards and their advisors in implementing the changes. The new Guidance offers helpful detailed advice and examples. The Guidance, published alongside the Code, aims to clarify principles and stimulate discussion for effective decision-making, within the familiar ‘comply or explain’ regime. The Code will apply to financial years starting on or after 1 January 2025.

-

Tim Page

Tim PageNote taking in Meetings

Read moreThe effective minuting of meetings is a deceptively challenging and time-consuming task, but one that is invaluable to boards and far more than an administrative formality. In our latest indigo INSIGHT, drawing upon the results of a recent LinkedIn poll, we consider the merits of different methods of in-meeting note taking, including on-the-spot typing, the use of recordings as well as traditional pen and paper.

-

Tim Page

Tim PageAmendments to the UK Corporate Governance Code

Read moreThe FRC have announced revisions to the UK Corporate Governance Code to enhance transparency and accountability for UK public limited companies, aiming to foster growth and competitiveness and attract investment. Key changes include clarifying reporting focus on board decisions, promoting diversity, strengthening risk management and introducing malus and clawback clauses in directors’ contracts. The revised Code will come into effect for financial years starting on or after 1 January 2025.

-

Tim Page

Tim PageThe Economic Crime and Corporate Transparency Act (the Act) new failure to prevent fraud offence

Read moreThe Economic Crime and Corporate Transparency Act introduced a new corporate offence (s199) – ‘failure to prevent fraud’. The offence, targeting large organisations, aims to protect victims, improve corporate culture, and could result in severe penalties, including an unlimited fine. Boards are advised to act now to ensure they have ‘reasonable procedures’ in place to mitigate fraud risks and provide them with a defence if necessary.

-

Tim Page

Tim PageECCT Act – an opportunity for governance professionals

Read moreBernadette Young welcomes the introduction of the Economic Crime and Corporate Transparency Act, endorsing the forthcoming statutory powers and obligations to enhance data accuracy at Companies House and to address current gaps in UK incorporation controls.

-

Tim Page

Tim PageMinute writing – an underestimated skill?

Read moreBoard minutes are an important management tool to ensure board decisions are clearly understood so they can be properly implemented. The skill of writing good minutes can be underestimated, however, which can lead to them not being given enough attention or resource.

-

Tim Page

Tim PageUK Corporate Governance Code consultation

Read moreThe consultation document on the UK

Corporate Governance Code has now been published. What do you need to know? -

Tim Page

Tim PageNot finished yet

Read moreAlthough the FTSE Women Leaders Review has reported real progress on targets to achieve female representation on boards, smaller listed companies still have a long way to go.

G+C

Indigo Governance > G+C