Interested in more industry insight, or think we can help? Get in touch with one of our Directors and keep up to date with the latest regulatory developments and any other news on LinkedIn and Twitter.

- Jun202025

id to go by Indigo: your solution for meeting new ECCTA ID verification requirements

Read moreid to go by Indigo provides a secure, compliant solution for identity verification in line with Companies House and ECCTA requirements. Designed for both individuals and complex organisations, our service ensures a smooth and efficient process backed by certified expertise. Read more about it here.

Tim Page - Jun172025

Over 400 points docked from English Football League clubs since dawn of Premier League for governance failings

Read moreOur new research reveals the devastating impact of governance failings across the English Football League (EFL).

Tim Page - Jun162025

Indigo Chambers Guide announcement

Read moreHaving already been rated as one of the Europe’s Fastest-Growing Companies in 2025 by the Financial Times, Indigo is now proud to announce it is one of only five firms to feature in this year’s internationally respected Chambers Guide.

Tim Page - May282025

Preparing for the Independent Football Regulator (IFR)

Read moreThe Independent Football Regulator will oversee compliance with new requirements for professional clubs in the top five tiers of English football. Here we look at what clubs need to do.

Tim Page - May282025

Getting your board ready for the Football Governance Code

Read moreA new governance code is on its way for English football clubs. Here we look at the steps board should be taking to ensure their governance is up to scratch.

Tim Page - May222025

Hurry up Harry

Read moreIn “Hurry up Harry”, Bernadette Young explores the recent governance breakdown at Sentebale, Prince Harry’s HIV and AIDS charity, now under scrutiny following high-profile trustee resignations, the patrons’ withdrawal, and a range of serious allegations against the board. What went wrong? Bernadette’s latest article in CGI’s Governance & Compliance magazine examines whether issues of board composition, poor transparency, deviation from the Charity Governance Code and a lack of professional governance support for the trustees, could offer crucial lessons for other third-sector leaders.

Tim Page - Feb112025

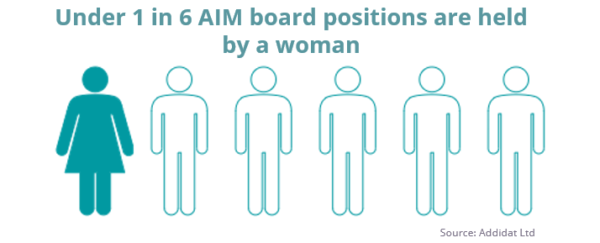

Gender Diversity in AIM Company Boards 2025

Read moreAddidat and Indigo: Independent Governance are excited to collaborate for a third successive year to offer insights into gender diversity on the boards of AIM-listed companies. Despite the progress made in the previous two years, it is disappointing to note that this year the ratio has remained stubbornly static. Our latest report reveals that just 1 in 6 directors is a woman, which is unchanged from last year. In addition to this, all-male boards have increased to 38%, further highlighting the persistent barriers to change. It’s time for a shift in perspective, one that prioritises equality, inclusion, and accountability in boardroom appointments.

Tim Page - Feb032025

Changes to ISS’s 2025 Voting Policy Guidelines for UK PLC AGMs

Read moreThe new ISS UK and Ireland proxy voting guidelines will apply to all general meetings from today onwards, as they look to adapt to significant shifts in governance and voting expectations.

In this latest IndigoINSIGHT we explore some of the key changes to the voting guidelines, which aim to reinforce accountability and transparency, and will need to be considered ahead of AGMs this year.Tim Page - Nov112024

Social Housing Governance

Read moreThe English social housing sector comprises of roughly 1,600 not-for-profit landlords or private registered providers, between them providing housing for approximately 6 million people across England. However, the social housing sector faces complex governance challenges due to varied legal structures, stakeholder expectations, and regulatory standards. In this latest IndigoINSIGHT we explore some of these challenges.

Tim Page - Oct162024

Subsidiary governance: part of the bigger picture

Read moreSubsidiary companies must sometimes navigate a labyrinth of regulations. For subsidiaries, and particularly those of multinational organisations, aligning the parent company’s policies and strategies can be both challenging and interesting.

Read here some important matters to take into consideration when deciding on your subsidiary governance framework and some tips on how to make it effective and workable.

Tim Page - Jul012024

Is more always better?

Read moreCommittees are a hugely valuable governance tool, helping boards ensure that there is appropriate oversight of core governance areas whilst freeing up their own time for more strategic matters. However, in this recent CGI article, Bernadette Young asks whether the recent proliferation of an increasing number of specialised committees risks overburdening non-executive directors and diluting their independence from management. This begs the question, is more always better?

Tim Page - May012024

Changes to Companies House fees

Read moreCompanies House fees are increasing on 1 May 2024, in some cases quite substantially. These new fees aim to support Companies House in carrying out its expanded investigation and enforcement responsibilities under the new Economic and Corporate Transparency Act 2023.

Tim Page - Apr162024

Reporting under the new UK Corporate Governance Code

Read moreEarlier this year, the Financial Reporting Council announced revisions to the UK Corporate Governance Code, aimed at enhancing transparency and accountability of UK public limited companies. In this fourth and final edition in our series of indigoINSIGHTs on the updates, we focus on how and where boards should report against the Code, the timings of the changes and how compliance will be monitored.

Tim Page - Mar262024

Preparing for the new UK Corporate Governance Code

Read moreFollowing the FRC’s publication of the UK Corporate Governance Code 2024 and associated guidance, the clock is now ticking for boards to fully understand the key changes and take action to review and update their governance arrangements where necessary. Our latest indigoINSIGHT explores the next steps for boards to consider in preparation for the new requirements.

Tim Page - Mar152024

Accredited as a Board Performance Reviewer by the Chartered Governance Institute

Read moreIndigo: independent governance is proud to announce it has been formally accredited as a provider of high quality board reviews by The Chartered Governance Institute UK and Ireland and is included in its directory of accredited providers. This testifies to our expertise in working with organisations to assess their board’s effectiveness and governance arrangements, helping them to reflect on their performance and pursue continuous improvement in governance and board-level decision making.

Tim Page - Mar072024

Gender diversity in AIM company boards

Read moreIn celebration of International Women’s Day 2024, Addidat and Indigo: Independent Governance are delighted to collaborate for a second year to provide insights into gender diversity on the boards of AIM quoted companies. Despite some progress, the lethargic pace of change remains disappointing, with 37% of AIM firms still lacking female representation. Diversity remains a crucial factor for optimising board effectiveness and commercial success and boards are therefore urged to take stock of their approach to equality and inclusion.

Tim Page - Feb222024

Guidance to the UK Corporate Governance Code 2024

Read moreIn the second Indigo INSIGHT in our series addressing changes to the UK Corporate Governance Code, we look at the guidance released by the FRC to support boards and their advisors in implementing the changes. The new Guidance offers helpful detailed advice and examples. The Guidance, published alongside the Code, aims to clarify principles and stimulate discussion for effective decision-making, within the familiar ‘comply or explain’ regime. The Code will apply to financial years starting on or after 1 January 2025.

Tim Page - Feb202024

Note taking in Meetings

Read moreThe effective minuting of meetings is a deceptively challenging and time-consuming task, but one that is invaluable to boards and far more than an administrative formality. In our latest indigo INSIGHT, drawing upon the results of a recent LinkedIn poll, we consider the merits of different methods of in-meeting note taking, including on-the-spot typing, the use of recordings as well as traditional pen and paper.

Tim Page - Feb152024

Amendments to the UK Corporate Governance Code

Read moreThe FRC have announced revisions to the UK Corporate Governance Code to enhance transparency and accountability for UK public limited companies, aiming to foster growth and competitiveness and attract investment. Key changes include clarifying reporting focus on board decisions, promoting diversity, strengthening risk management and introducing malus and clawback clauses in directors’ contracts. The revised Code will come into effect for financial years starting on or after 1 January 2025.

Tim Page - Jan082024

The Economic Crime and Corporate Transparency Act (the Act) new failure to prevent fraud offence

Read moreThe Economic Crime and Corporate Transparency Act introduced a new corporate offence (s199) – ‘failure to prevent fraud’. The offence, targeting large organisations, aims to protect victims, improve corporate culture, and could result in severe penalties, including an unlimited fine. Boards are advised to act now to ensure they have ‘reasonable procedures’ in place to mitigate fraud risks and provide them with a defence if necessary.

Tim Page

Interested in more industry insight, or think we can help? Get in touch with one of our Directors and keep up to date with the latest regulatory developments and any other news on LinkedIn and Twitter.