-

Tim Page

Tim PageShareholder rebellion surge in 2025 with FTSE100 pay revolts doubling

Read moreNew research from Indigo shows shareholder rebellions at FTSE 100 AGMs nearly doubled in 2025, rising from eight to 15 companies. The increase was driven by growing investor opposition to executive pay, with revolts against remuneration policies and reports doubling year on year.

-

Tim Page

Tim PageBeyond compliance: how Provision 29 raises the bar for UK boards

Read moreProvision 29 of the updated UK Corporate Governance Code is a game changer. From January 2026, premium-listed companies must adopt and provide clear, evidence-based reporting on the effectiveness of their risk management and internal controls, shifting the emphasis towards boards demonstrating comprehensive oversight.

-

Tim Page

Tim PageIntroducing PISCES

Read moreConfirmed in June 2025, the UK’s PISCES regime offers private companies a way to provide shareholder liquidity through periodic share trading, with tax advantages and flexibility for employees and founders. We can help businesses navigate the PISCES process, making it simple and cost-effective.

-

Tim Page

Tim PageNew failure to prevent fraud offence

Read moreFrom 1 September 2025, large organisations can be prosecuted for failing to prevent fraud by employees, agents, or subsidiaries. We have outlined the steps boards should take to establish reasonable procedures as a defence against these offences.

-

Tim Page

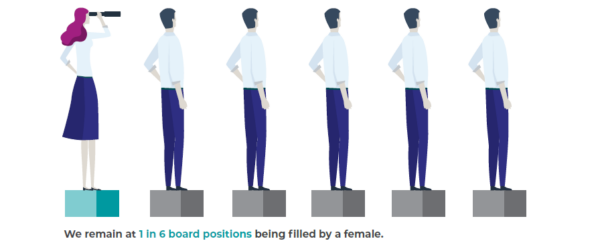

Tim PageGender Diversity in AIM Company Boards 2025

Read moreAddidat and Indigo: Independent Governance are excited to collaborate for a third successive year to offer insights into gender diversity on the boards of AIM-listed companies. Despite the progress made in the previous two years, it is disappointing to note that this year the ratio has remained stubbornly static. Our latest report reveals that just 1 in 6 directors is a woman, which is unchanged from last year. In addition to this, all-male boards have increased to 38%, further highlighting the persistent barriers to change. It’s time for a shift in perspective, one that prioritises equality, inclusion, and accountability in boardroom appointments.

-

Tim Page

Tim PageChanges to ISS’s 2025 Voting Policy Guidelines for UK PLC AGMs

Read moreThe new ISS UK and Ireland proxy voting guidelines will apply to all general meetings from today onwards, as they look to adapt to significant shifts in governance and voting expectations.

In this latest IndigoINSIGHT we explore some of the key changes to the voting guidelines, which aim to reinforce accountability and transparency, and will need to be considered ahead of AGMs this year. -

Tim Page

Tim PageSocial Housing Governance

Read moreThe English social housing sector comprises of roughly 1,600 not-for-profit landlords or private registered providers, between them providing housing for approximately 6 million people across England. However, the social housing sector faces complex governance challenges due to varied legal structures, stakeholder expectations, and regulatory standards. In this latest IndigoINSIGHT we explore some of these challenges.

-

Tim Page

Tim PageSubsidiary governance: part of the bigger picture

Read moreSubsidiary companies must sometimes navigate a labyrinth of regulations. For subsidiaries, and particularly those of multinational organisations, aligning the parent company’s policies and strategies can be both challenging and interesting.

Read here some important matters to take into consideration when deciding on your subsidiary governance framework and some tips on how to make it effective and workable.

-

Tim Page

Tim PageReporting under the new UK Corporate Governance Code

Read moreEarlier this year, the Financial Reporting Council announced revisions to the UK Corporate Governance Code, aimed at enhancing transparency and accountability of UK public limited companies. In this fourth and final edition in our series of indigoINSIGHTs on the updates, we focus on how and where boards should report against the Code, the timings of the changes and how compliance will be monitored.

-

Tim Page

Tim PagePreparing for the new UK Corporate Governance Code

Read moreFollowing the FRC’s publication of the UK Corporate Governance Code 2024 and associated guidance, the clock is now ticking for boards to fully understand the key changes and take action to review and update their governance arrangements where necessary. Our latest indigoINSIGHT explores the next steps for boards to consider in preparation for the new requirements.

indigoINSIGHT

Indigo Governance > indigoINSIGHT